What Is The Capital Assets Pricing Models (CAPM)

What is CAPM?

CAPM sounds cool !!! It stands for "Capital Assets Pricing Model." Wait!! Before you say its too complicated to understand, look at the basic definition of CAPM:

This model is used to calculate the required rate of return for the risky asset. Here the required rate of return means the expected increased value which you should expect to get due to the level of risk present in the asset.

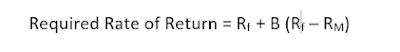

Formula:

Here:

RF = Risk Free Rate

RM = Return On Market

B = Beta (Level of Risk)

CAPM equation is divided into two parts:

First Return of Risk-Free (RF)

Second Return on Market Risk (RF - RM)

Still don't get it? Is it too difficult to comprehend? Now you should not be worried at all,

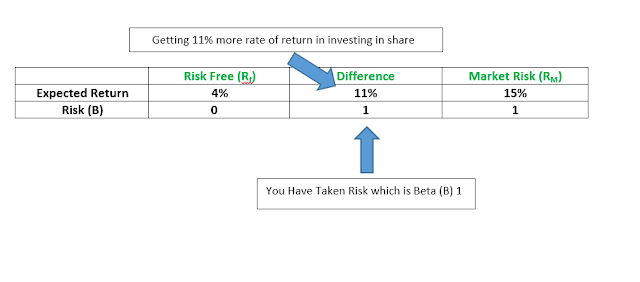

Here we are going to make it so easy for you conclusively. You already knew that to make an investment, two essential things are considered by an investor.

- How much rate of return is there?

- How much risk is present in undertaking the investment.

We are going to understand this concept with a simple example:

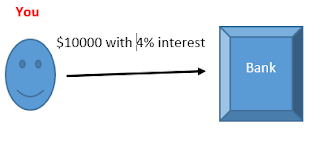

Suppose you have $1000 and you want to deposit it in the bank into saving account with 4% interest rate.

Scenario 1:

In the above scenario you are getting:

4% Return

& RF (Risk-Free)

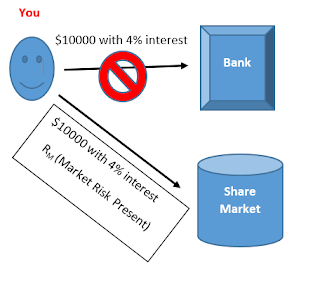

Scenario 2:

If we ask you to invest same $10000 to the Share market at 4% return rate where market risk is already inherent, would you like to spend your money here or you will choose scenario 1 where you were getting 4% rate without any involvement of risks. Offcourse your answer would be Scenario 1 due to risk-free.

Scenario 3:

In order to convince you to invest in share market where risk is present, we will have to offer you the higher rate of return then risk-free investment discussed in Scenario 1.

Now you would like to take this offer as it has the much higher rate of return than the previous proposal. In a simple manner, to compensate higher rate of return for taking the risk.

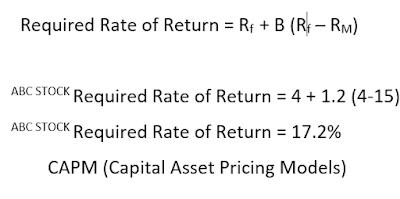

Scenario 4:

Lets through the twist here, now we are offering you to invest in ABC stock at the rate of same 15%, but this stock has the risk of beta 1.2. Here a question arises would you invest in a stock which offers the same rate of return with more risk involved. The answer is "NO."

So what should be your required rate of return for investing in a stock which involves more risk?

Simply put above data in the formula to get the answer:

You can see the ABC Stock has more risk and also has more return so you would positively undertake this investment. CAPM concept is easy once you get to the central idea of it.

Comments

Post a Comment